Tokenomics and Economic Models

What you should understand to improve your investment choices

Introduction

The advent of blockchain technology has not only revolutionized the financial landscape but has also ushered in a new era of decentralized ecosystems. At the heart of this transformation lies the intricate design of tokens and their economic models, collectively known as tokenomics. In this article, we explore the diverse economic models of various tokens and cryptocurrencies, seeking to understand their impact on the success and sustainability of blockchain projects.

Understanding Tokenomics

Tokenomics is a portmanteau of "token" and "economics," representing the economic system underlying a cryptocurrency or token. It encompasses a wide array of factors, including the token's distribution, utility, governance mechanisms, and overall economic structure. Tokenomics plays a pivotal role in shaping the behavior of participants within a blockchain ecosystem, influencing adoption, liquidity, and the overall success of the project.

Diverse Economic Models

Blockchain projects employ a variety of economic models to achieve their goals. Some tokens serve as a medium of exchange, facilitating transactions within a network. Others derive value from their utility, providing access to specific functionalities or services within the ecosystem. Additionally, governance tokens empower holders to participate in decision-making processes, fostering a decentralized and inclusive approach to project development.

Let's examine a few prominent economic models:

Utility Tokens:

- Utility tokens derive their value from the services or benefits they offer within a particular platform. These tokens grant users access to specific features, products, or services, creating demand based on their utility. For instance, platforms offering decentralized finance (DeFi) services often have utility tokens that provide holders with voting rights or discounted transaction fees.

Governance Tokens:

- Governance tokens are designed to empower holders with decision-making authority within a decentralized ecosystem. Holders can vote on proposals related to protocol upgrades, parameter changes, or other governance-related decisions. Projects like Compound and Uniswap have successfully implemented governance tokens, allowing community members to actively participate in shaping the project's future.

Stablecoins:

- Stablecoins are pegged to the value of a fiat currency or a basket of assets to minimize price volatility. These tokens aim to provide a stable unit of account and a reliable medium of exchange within the volatile cryptocurrency market. Tether (USDT), USD Coin (USDC), and DAI are examples of stablecoins widely used in the crypto space.

Evaluating the Impact: Success Measured Beyond Price Charts

The choice of economic model significantly influences a blockchain project's success and sustainability. A well-designed tokenomics framework aligns the interests of participants, fostering a vibrant and engaged community. On the other hand, poorly conceived tokenomics can lead to issues such as token price volatility, lack of adoption, and governance challenges.

While token price often takes center stage, it's only one measure of a project's success. A well-crafted tokenomic model can drive positive outcomes even when price charts don't paint a rosy picture. Here's how:

Community Engagement:

- Effective tokenomics can cultivate a strong and active community. Projects that incentivize users through token rewards, staking mechanisms, or governance participation often experience higher engagement levels. A thriving community becomes a driving force behind the project's success, contributing to its sustainability in the long run.

Liquidity and Adoption:

- Tokenomics directly influences liquidity and adoption rates within a blockchain ecosystem. Tokens with clear use cases and tangible benefits are more likely to attract users and investors. Furthermore, projects that implement liquidity mining or yield farming initiatives can stimulate liquidity by providing incentives for users to contribute assets to liquidity pools.

Governance and Decentralization:

- The adoption of governance tokens promotes decentralization by giving community members a voice in decision-making processes. This decentralized governance structure enhances transparency and reduces reliance on centralized entities, contributing to the overall sustainability of the project.

Let's examine a case study to illustrate the impact of tokenomics on blockchain project success:

Uniswap (UNI):

- Uniswap, a decentralized exchange protocol, introduced the UNI governance token to its users. By distributing tokens to past users and liquidity providers, Uniswap incentivized community participation. This move not only boosted liquidity on the platform but also empowered the community to actively contribute to the protocol's evolution.

Guide to Assessing Tokenomics

Evaluating tokenomics demands meticulous due diligence, and this step-by-step guide aims to facilitate your journey:

- Commence with the Whitepaper & Official Documentation

- Purpose & Vision: Identify the problem the project addresses and why a token is essential.

- Technical Details: Examine the technological infrastructure and how the token integrates.

- Economic Model: Understand the token's role in driving demand, ensuring security, and providing utility.

- Check Vesting Schedule for Team Tokens

- Assess the allocation for the team and advisors, ensuring it aligns with industry standards (typically 10-20%).

- Consider the vesting period, indicating the team's commitment, and watch for potential cliffs.

- Private or Seed Sales Investigation

- Explore any private or seed sales, comparing token prices with public sales or the current market.

- Investigate special conditions for early investors, such as extended vesting or bonus tokens, for insights into potential selling pressures.

- Token Utility in Real-World Applications

- Scrutinize the token's utility, examining its role as a governance token, medium of exchange, or staking asset.

- Look for partnerships, integrations, or real-world use cases validating the token's utility.

- Examine the Project's Monetary Policy

- Burns: Evaluate token burn mechanisms to understand how scarcity is introduced.

- Buy-backs: Assess projects using profits for token buy-backs and their impact on supply and demand.

- Staking & Rewards: Consider the impact of staking rewards on tokenomics and potential inflationary pressures.

- Treasury & Funding: Examine the project's funding mechanism and allocation for future development.

- Community & Governance

- Analyze governance rights and the decentralization of decision-making.

- Assess community engagement as an indicator of the project's health and credibility.

- Transparency & Security

- Check for regular updates on developments, partnerships, and changes in tokenomics.

- Investigate if the project undergoes periodic security audits, with results transparently shared.

- Economic Barriers & Entry Costs

- Assess entry barriers and costs associated with utilizing the token, considering potential impacts on adoption.

- Market Analysis (if already listed)

- Examine trading volume, liquidity, and exchange listings. High liquidity and reputable exchange presence indicate trust and demand.

- Exercise caution with tokens on lesser-known exchanges or minimal trading activity.

- Competitive Analysis

- Evaluate the project's standing compared to competitors, considering its unique value proposition and tokenomics.

By systematically navigating these steps and critically evaluating each aspect, investors can gain a comprehensive understanding of a project's tokenomics. This not only informs investment decisions but also helps discern genuine value propositions from speculative or poorly-structured ventures.

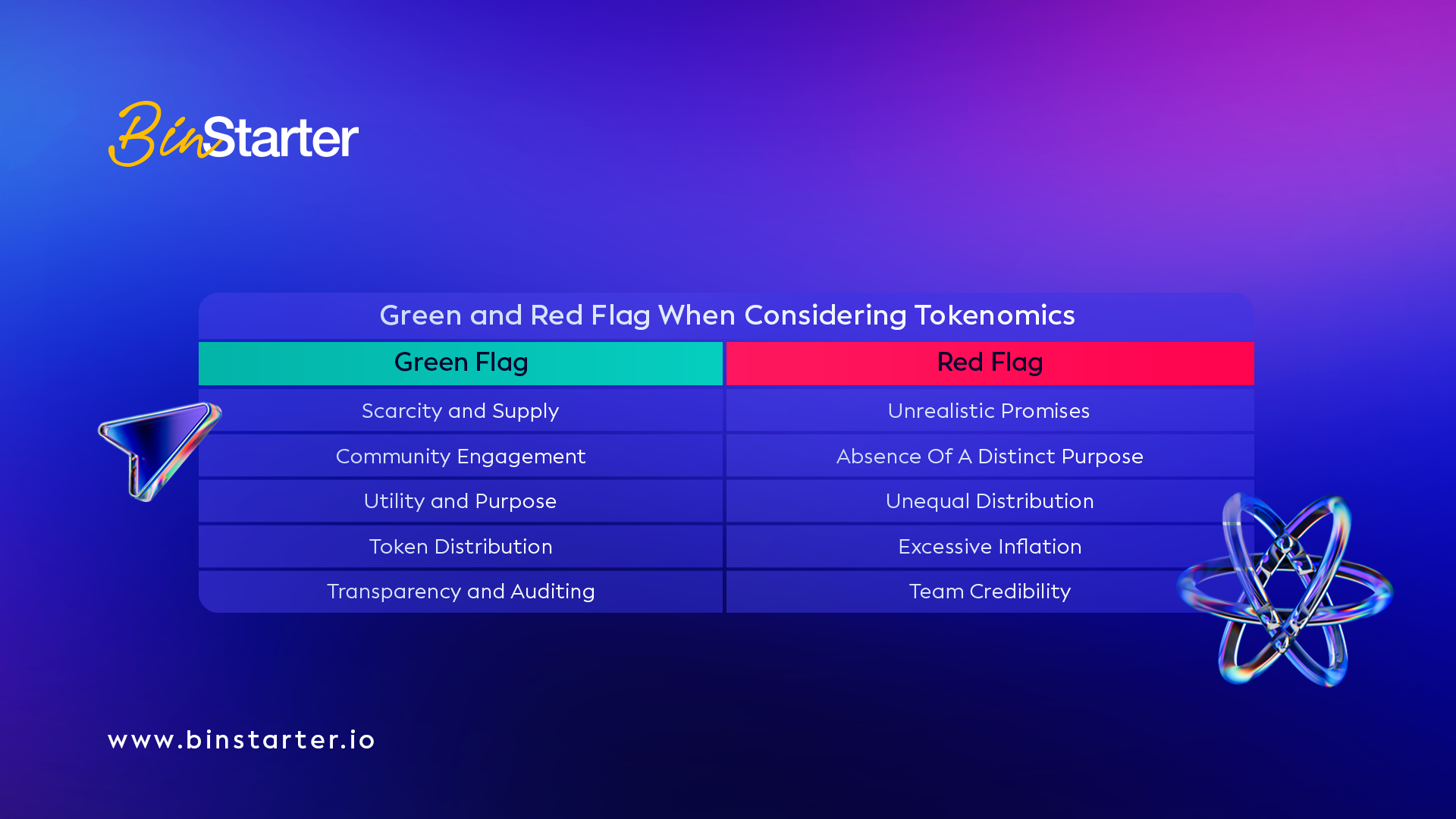

Green and Red Flags to Consider in Tokenomics

When delving into the world of cryptocurrency investments, an essential aspect to scrutinize is the tokenomics outlined in a project’s white paper. A comprehensive analysis of tokenomics, encompassing design principles and associated data, serves as a valuable guide for investors to navigate away from poorly designed ventures. In this section, we explore prominent positive (green flags) and negative (red flags) indicators to consider when evaluating the tokenomics of crypto projects.

Green Flags

Utility and Purpose:

- Just as you seek a purpose in a new gadget, a token with a clear utility and purpose is a significant green flag. Look for projects addressing real-world issues or enhancing existing ecosystems. If the token plays a vital role within the project, consider it a positive signal.

Scarcity and Supply:

- Similar to rare collectibles, scarcity can drive value. A token with a limited supply has the potential to gain value over time. Keep an eye on tokens implementing mechanisms to control inflation or adjust supply based on demand.

Community Engagement:

- Healthy communities often indicate a project’s longevity. An active and engaged community discussing a token's potential is a positive sign. Explore forums, social media, and online discussions to gauge the enthusiasm within the community.

Token Distribution:

- The distribution of tokens is of utmost importance. A well-balanced distribution prevents a small group from having excessive control. Seek projects with fair allocations to early adopters, team members, investors, and the broader public.

Transparency and Auditing:

- In the crypto world, transparency is invaluable. Projects undergoing regular audits by reputable firms demonstrate a commitment to security and honesty. If they openly share their code and financials, it's a positive indication that they have nothing to hide.

Red Flags

Unrealistic Promises:

- If a project promises sky-high returns with minimal effort, exercise caution. Tokens focused solely on price appreciation without a solid use case may be headed for a crash.

Lack of Clear Use Case:

- A token without a clear purpose is akin to a ship without a rudder. If understanding the token's role within the project is challenging, it might be best to avoid.

Uneven Distribution:

- A small group holding a significant portion of tokens can lead to centralization and manipulation. Exercise caution if a handful of wallets control the majority of the token supply.

Unsustainable Inflation:

- Excessive inflation can erode value over time. If a token lacks mechanisms to control its supply or inflation rate, it may not hold its value in the long term.

Team Credibility:

- The team behind a project is crucial. A faceless or anonymous team raises concerns about intentions. Research the blockchain development company and its team members – their experience, track record, and reputation in the crypto space.

Think of evaluating tokenomics and design principles like solving a treasure map. Green flags indicate a strong foundation, while red flags signal caution. Conduct thorough research, ask questions, and avoid rushing into decisions to ensure a well-informed investment strategy.

Conclusion

Tokenomics serves as the backbone of blockchain projects, influencing their success and sustainability. By studying and understanding the diverse economic models employed within the crypto space, stakeholders can make informed decisions, fostering the growth of vibrant and resilient ecosystems. As the blockchain industry continues to evolve, the role of tokenomics will remain central to shaping the future of decentralized finance, governance, and innovation.

About Binstarter

Launched in June 2021, Binstarter is a trailblazer in decentralized finance, renowned as the first multi-chain IDO platform with an Extended Insurance Protocol (EIP). Our platform is committed to transparency, fairness, and innovation, offering secure and efficient fundraising solutions for startups. At Binstarter, we aim to revolutionize the DeFi landscape by reducing risks, enhancing user experiences, and empowering startups for successful launches.

Website | Announcement Channel | Telegram Chat | Twitter | Blog

BinStarter Blog & News Newsletter

Join the newsletter to receive the latest updates in your inbox.